"Fuel Your Growth with UltimateCRM – The Powerhouse for Marketing and Sales!"

0161 524 5255

All the bells and whistles, minus the migraine and inflated price tag!

You will ask where we have been your whole life.

All the bells and whistles, minus the migraine and inflated price tag!

You will ask where we have been all your life.

Clients

Clients

We're In The Business Of Helping You

Grow Your Business

UltimateCRM is the first-ever all-in-one platform that will give you the tools, support and resources you need to succeed and crush your marketing goals.

Watch Demo

BRANDING

WE BUILD AND CREATE

SOCIAL MEDIA

MANAGEMENT and MARKETING

LEAD GENERATION

GOOGLE ADWORDS AND META

AUTOMATION

NUTURE LEADS USING AUTOMATION

Watch Demo

We're In The Business Of Helping You

Grow Your Business

UltimateCRM is the first-ever all-in-one platform that will give you the tools, support and resources you need to succeed and crush your marketing goals.

BRANDING

WE BUILD AND CREATE

SOCIAL MEDIA

MANAGEMENT and MARKETING

LEAD GENERATION

GOOGLE ADWORDS AND META

AUTOMATION

NUTURE LEADS USING AUTOMATION

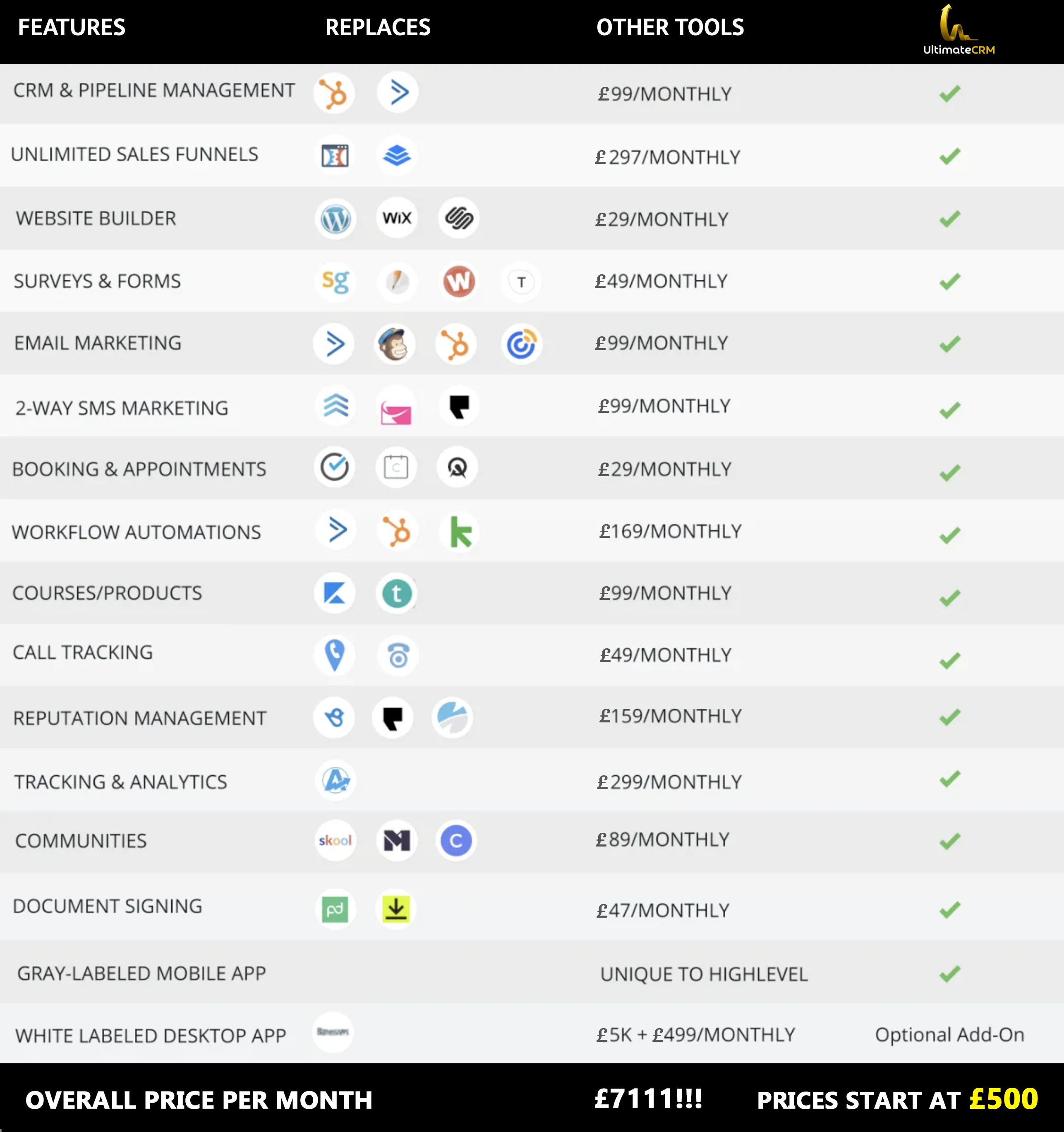

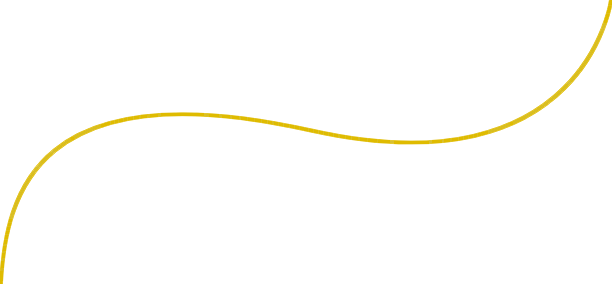

UltimateCRM Has Everything

You Need To Succeed

We help you consolidate all of your marketing tools.

UltimateCRM Has Everything

You Need To Succeed

We help you consolidate all of your marketing tools.

Designed for Business Owners Like You

If you’re tired of juggling multiple platforms and missing out on potential customers, UltimateCRM brings everything together. Manage your website, sales funnels, marketing campaigns, and customer communication—all from one dashboard.

Grow Your Business with Confidence

UltimateCRM provides the tools you need to automate, optimise, and scale your business. Whether you're selling services or products, UltimateCRM's intuitive interface makes it easy to create an efficient workflow that delivers results.

Ready To Take Control of Your Business Growth?

Get started with UltimateCRM today and watch your business thrive with less effort and more control. Contact us for a free marketing consultation and a more details demo of our CRM.

Designed for Business Owners Like You

If you’re tired of juggling multiple platforms and missing out on potential customers, UltimateCRM brings everything together. Manage your website, sales funnels, marketing campaigns, and customer communication—all from one dashboard.

Grow Your Business with Confidence

UltimateCRM provides the tools you need to automate, optimise, and scale your business. Whether you're selling services or products, UltimateCRM's intuitive interface makes it easy to create an efficient workflow that delivers results.

Ready To Take Control of Your Business Growth?

Get started with UltimateCRM today and watch your business thrive with less effort and more control. Contact us for a free marketing consultation and a more details demo of our CRM.

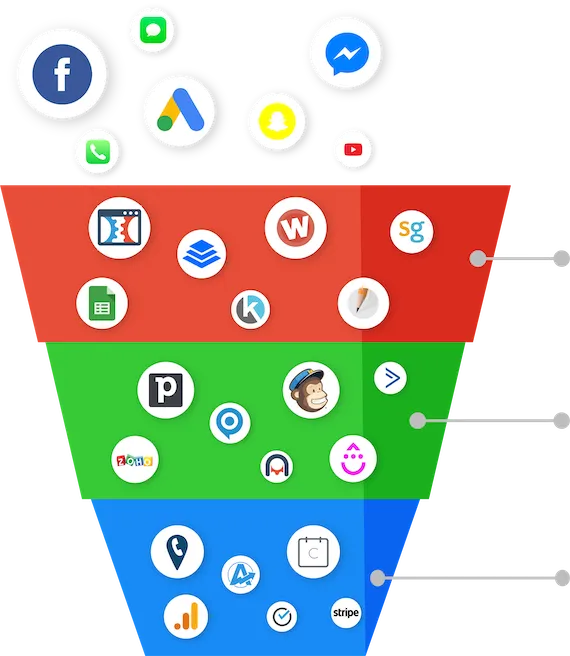

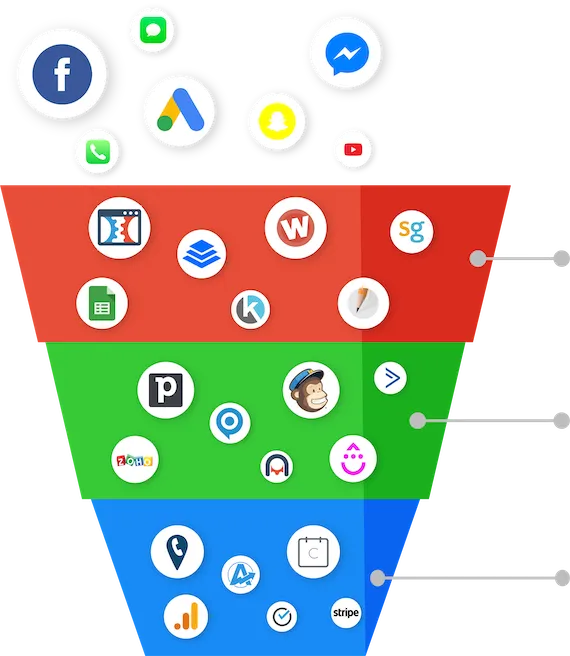

Building The Digital Marketing Engine

All the tools you need in one platform without having to "duct-tape" multiple platforms together!

capture

Capture leads using our landing pages, surveys, forms, calendars, inbound phone system & more!

Nurture

Automatically message leads via voicemail, forced calls, SMS, emails, FB Messenger, WhatsApp & more!

CLOSE

Use our built in tools to collect payments, schedule appointments, and track analytics!

Building The Digital Marketing Engine

All the tools you need in one platform without having to "duct-tape" multiple platforms together!

capture

Capture leads using our landing pages, surveys, forms, calendars, inbound phone system & more!

Nurture

Automatically message leads via voicemail, forced calls, SMS, emails, FB Messenger, WhatsApp & more!

CLOSE

Use our built-in tools to collect payments, schedule appointments, and track analytics!

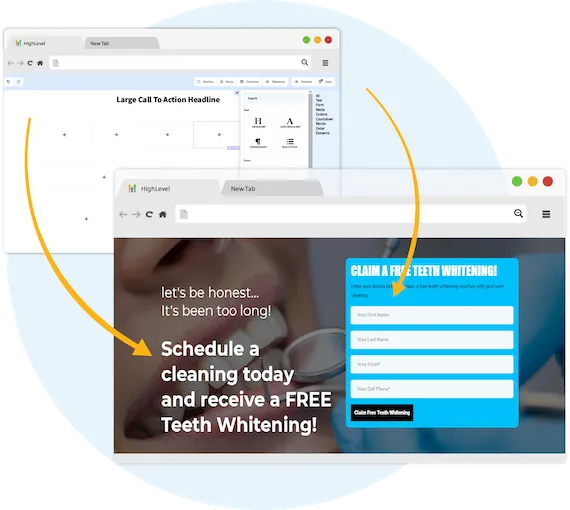

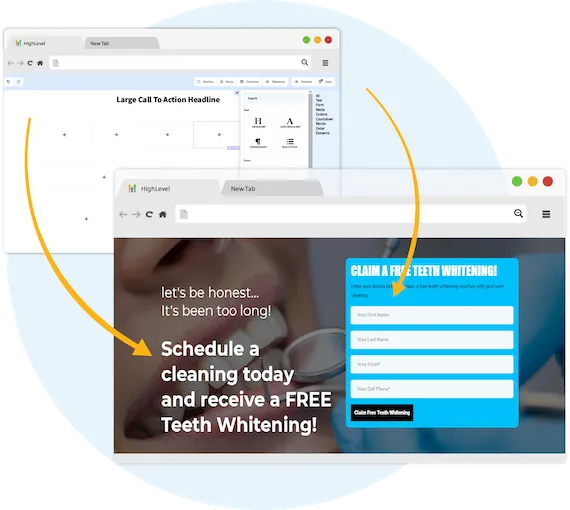

create amazing landing pages in minutes with the ultimatecrm funnel builder

Funnel Builder:

UltimateCRM is a Full Suite Platform for Marketers. Included in the Platform is a full featured Page Builder to capture leads. Create high-converting funnels that guide your leads through every step of the buying process.

CREATE FULL WEBSITES, funnels & LANDING PAGES

Our intuitive platform allows you to create full featured websites with custom menus. Create high-performing and captivating landing pages all in one place!

DRAG & DROP SURVEYS AND FORMS

Built right in is the ability to capture leads through Surveys and capture forms. You can integrate directly with our page builder or embed them on your own sites.

ONLINE APPOINTMENT SCHEDULING

The major step for many businesses is to capture appointments and request appointments. We've built our own calendar application within UltimateCRM so you can capture the appointment all in one straightforward flow.

Funnel Builder:

create amazing landing pages in minutes with the ultimatecrm funnel builder

UltimateCRM is a Full Suite Platform for Marketers. Included in the Platform is a full featured Page Builder to capture leads. Create high-converting funnels that guide your leads through every step of the buying process.

Create Full Websites, Funnels & Landing Pages

Our intuitive platform allows you to create full featured websites with custom menus. Create high-performing and captivating landing pages all in one place!

Drag and Drop Surveys

and Forms

Built right in is the ability to capture leads through Surveys and capture forms. You can integrate directly with our page builder or embed them on your own sites.

Online Appointment Scheduling

The major step for many businesses is to capture appointments and request appointments. We've built our own calendar application within UltimateCRM so you can capture the appointment all in one straightforward flow.

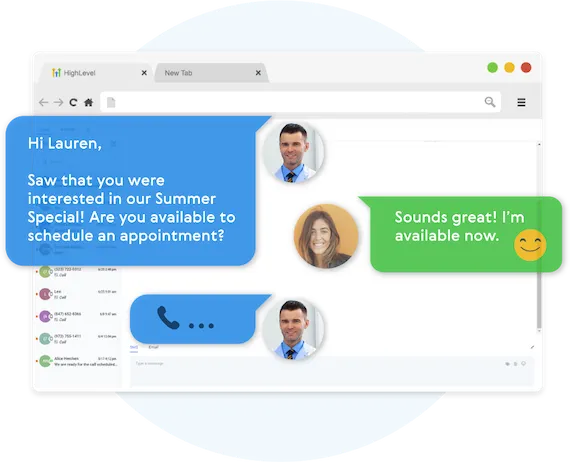

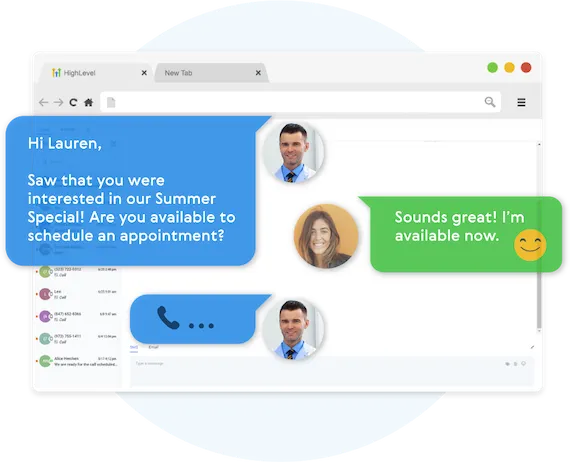

Consolidated Chat Streams:

The backbone of UltimateCRM is what you are able to accomplish after you capture the lead. Stay connected with your customers through a single interface, managing conversations across different platforms (E-mail, SMS, Facebook, Instagram, WhatsApp and more).

Easily Customise your follow-up campaigns

Our Multi-channel follow up campaigns allow you to automate engaging follow ups and capture engaged responses from your leads.

create multi-channel campaigns

UltimateCRM allows you to connect with your leads through Phone Connect, Voicemail Drops, SMS/MMS, Emails, WhatsApp and even Facebook Messenger.

two-way communication on any device

Our full featured mobile app allows you to communicate with your leads on all devices.

Our full featured mobile app allows you to communicate with your leads on all devices.

Consolidated Chat Streams:

The backbone of UltimateCRM is what you are able to accomplish after you capture the lead. Stay connected with your customers through a single interface, managing conversations across different platforms (E-mail, SMS, Facebook, Instagram, WhatsApp and more).

Easily Customise your follow-up campaigns

Our Multi-channel follow up campaigns allow you to automate engaging follow ups and capture engaged responses from your leads.

Create Multi-Channel Campaigns

UltimateCRM allows you to connect with your leads through Phone Connect, Voicemail Drops, SMS/MMS, Emails, WhatsApp and even Facebook Messenger.

Two-way Communication On Any Device

Our full featured mobile app allows you to communicate with your leads on all devices.

Fully Automated Booking System:

Let UltimateCRM handle your bookings from scheduling to confirmations—automatically.

automated nurture conversations

Create text conversations with the goal of placing booked appointments on calendars WITHOUT any human interaction.

Full customization of messaging

Use our campaign builder to customIse the messaging.

artificIal intelligence built in

UlitmateCRM allows you to leverage AI (Artificial Intelligence) and Machine Learning to manage the conversation.

Large Call to Action Headline

Fully Automated Booking System:

Let UltimateCRM handle your bookings from scheduling to confirmations—automatically.

Automated Nurture Conversations

Create text conversations with the goal of placing booked appointments on calendars WITHOUT any human interaction.

Full Customization of Messaging

Use our campaign builder to customIse the messaging.

artificIal intelligence

built-in

UlitmateCRM allows you to leverage AI (Artificial Intelligence) and Machine Learning to manage the conversation.

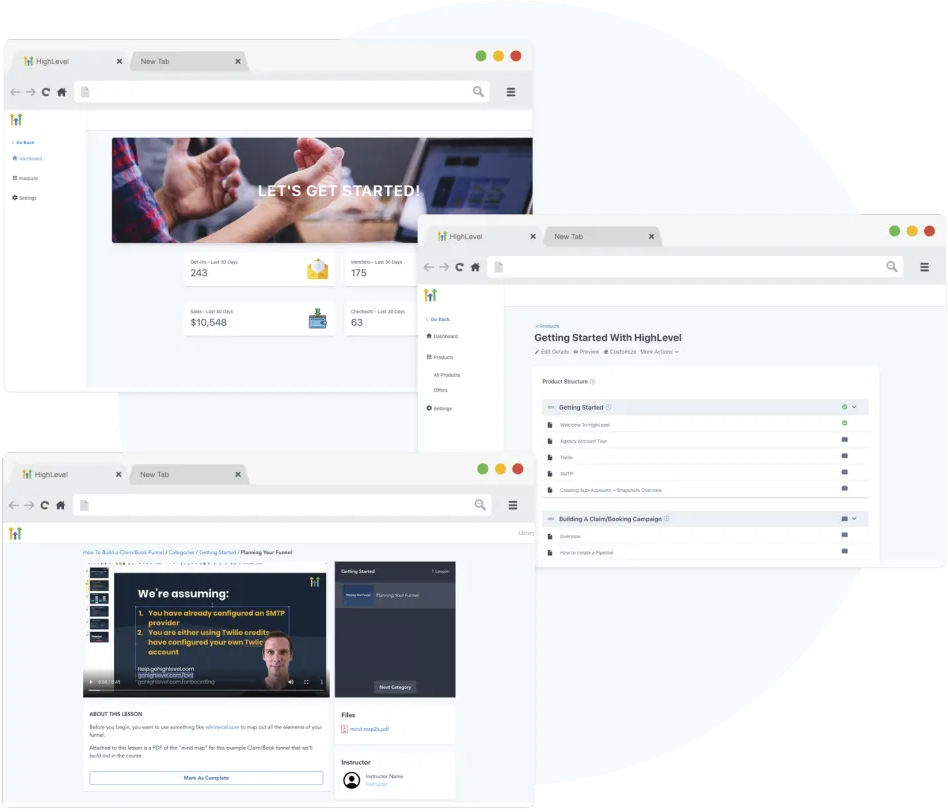

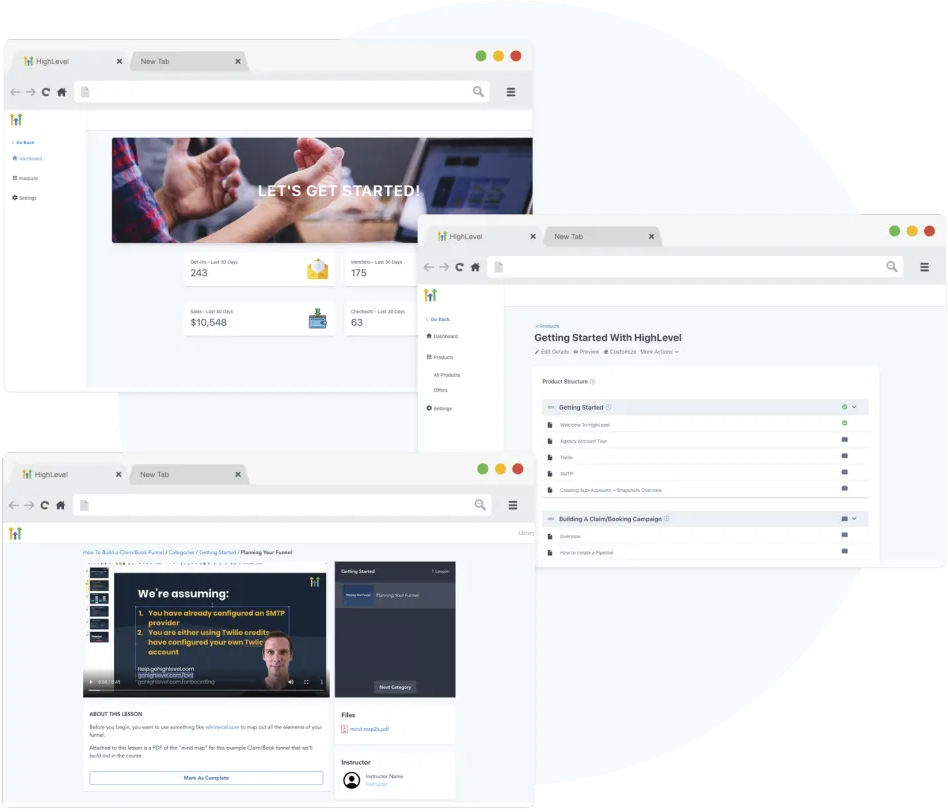

Create Membership Platforms:

Launch exclusive membership sites to offer premium content and grow recurring revenue.

FULL FEATURED COURSE MANAGEMENT

Build Full Courses with unlimited video hosting and unlimited users.

OFFER FREE AND PAID COURSES

With our full Platform you can sell courses or offer courses for free, all in one product!

Unlimited usage!

UltimateCRM offers unlimited users, offers, and products for your courses. You can create courses for your clients or for your own business!

Create Membership Platforms:

Launch exclusive membership sites to offer premium content and grow recurring revenue.

Full Featured Course Management

Build Full Courses with unlimited video hosting and unlimited users.

Offer Free and Paid Courses

With our full Platform you can sell courses or offer courses for free, all in one product!

Unlimited Usage!

UltimateCRM offers unlimited users, offers, and products for your courses. You can create courses for your clients or for your own business!

Close More Deals

Our thriving community of the most successful and visionary digital marketers on the planet. Get all the training and resources you need to start or grow your business.

manage your workflow and pipeline

With our built-in Pipeline Management feature, you can keep track of where the leads are and what stage they are in the sales funnel.

collect customer payments

We integrate directly with Stripe so you can collect payments on websites, funnels, and even when someone books an appointment.

all the analytics & reports in one place

Our dashboard keeps an overview of where the leads are, and how much money has been generated on each phase.

Large Call to Action Headline

Close More Deals

Our thriving community of the most successful and visionary digital marketers on the planet. Get all the training and resources you need to start or grow your business.

Manage Your Workflow And Pipeline

With our built-in Pipeline Management feature, you can keep track of where the leads are and what stage they are in the sales funnel.

Collect Customer Payments

We integrate directly with Stripe so you can collect payments on websites, funnels, and even when someone books an appointment.

All The analytics & reports in one place

Our dashboard keeps an overview of where the leads are, and how much money has been generated on each phase.

Marketing Automation:

Streamline your email, social media, and SMS campaigns with automation for effortless lead nurturing. Set up customised workflows to deliver timely, relevant content, boosting engagement and conversions hands-free.

This efficient approach saves time and drives better results.

all the tools you need in one platform

The UltimateCRM Platform is everything that marketers need to manage their leads, websites, funnels, calendars and many other services that are needed to maintain a customer.

Large Call to Action Headline

Marketing Automation:

Streamline your email, social media, and SMS campaigns with automation for effortless lead nurturing. Set up customised workflows to deliver timely, relevant content, boosting engagement and conversions hands-free.

This efficient approach saves time and drives better results.

all the tools you need in one platform

The UltimateCRM Platform is everything that marketers need to manage their leads, websites, funnels, calendars and many other services that are needed to maintain a customer.

Top-Notch Support

We are striving to offer the best possible support to our customers.

makes switching easy

Within the platform we can one-click import from your previous marketing tools.

Multi-channel support

Reach out to a member of our support team with our Live Chat options, Email or even Phone to assist even further.

Large Call to Action Headline

Top-Notch Support

We are striving to offer the best possible support to our customers.

makes switching easy

Within the platform we can one-click import from your previous marketing tools.

Multi-channel support

Reach out to a member of our support team with our Live Chat options, Email or even Phone to assist even further.

by MARKETERS, for MARKETERS

Why UltimateCRM is a Must-Have for Marketers:

UltimateCRM is built by marketers, for marketers, solving everyday challenges businesses face.

It simplifies lead management, automates campaigns, and offers powerful analytics, helping you focus on growing your brand and converting leads.

With seamless integration and data-driven insights, it's the essential tool to boost efficiency and maximise results.

by MARKETERS, for MARKETERS

Why UltimateCRM is a Must-Have for Marketers:

UltimateCRM is built by marketers, for marketers, solving everyday challenges businesses face.

It simplifies lead management, automates campaigns, and offers powerful analytics, helping you focus on growing your brand and converting leads.

With seamless integration and data-driven insights, it's the essential tool to boost efficiency and maximise results.

MEET THE TEAM

MEET THE TEAM

Are you ready for the BIG TIME?

Discover What UltimateCRM Can Do For You & Your Business

Are you ready for the BIG TIME?

Discover What UltimateCRM Can Do For You & Your Business

ULTIMATE MARKETING (GLOBAL) LTD

Ground Floor, Nautica House, Waters Meeting Road,

Bolton, England, BL1 8SW

Registered with the Information Commissioner under the Data Protection Act 2018